How to launch payments with bill_line: a full guide

The bill_line team is online, and today we‘re starting a new section in our blog. This will be a series of guides in which we’ll take a closer look at how every business can launch our payment solution on their website or app – and earn more. In the series of articles, we’ll go all the way from connection and tech integration to the first transaction, dealing with the personal account, about settlements and regular updates.

Our first text is about whatare the main steps to connect payment solution from bill_line on your website or application.

Step #1: Application for connection

Our cooperation begins with getting to know each other. We’ve developed a simple application form for connecting payments: it’s 1-2 minutes from you to fill it out, and we provide you with a plan of what and how to start payments as quickly as possible.

Why do we need anything other than your name, contacts and a short description? Let’s tell you point by point:

- Link to your project: this way we’ll immediately see if it’s ready for launch and, if necessary, we’ll prepare advice on what can be done better;

- Your business niche: retail, services or gaming – each area has its own rules and conditions, including ones from payment systems;

- Country: with this we’ll select suitable payment methods and legal requirements;

- Turnover: tech integration terms, individual fees – it all depends on how quickly you are developing!

The application will immediately be sent to our bizdev team, which will start working on it. After the initial analysis, we’ll contact you in a way convenient for you and begin working together.

Step #2: Preparing and checking the merchant

We’ll do a special article for this step later. But first, let’s sort out the terms that you mayn’t know and study step by step what needs to be done for further success.

Merchant – this is what fintech calls the subject of payment acceptance. That’s you as a legal entity. You can manage all aspects of your work as a merchant in your bill_line personal account.

How to prepare your website or app to payments acceptance?

In 90% of cases, your project is already done with that, because it has all the necessary information and features — you already know what you need. If not – the full list of requirements is available in this link, but we’ll remind you of the main ones:

- Your business activities shouldn’t contradict the current legislation of the country in which you plan to work;

- The website or app must contain basic information about you: name, details and contacts. This can be done either in a separate section or in the footer of the website;

- For some projects (for example, online stores), it’s important to have a privacy policy, cookie policy or otherpolicy regarding personal information used for advertising purposes;

- The site or application must be fully functional on all pages/sections. In the case of a website, it’s also important to have an adaptation for mobile devices: this is necessary for the correct operation of the payment form.

Our highest score from application to connection is 3.5 hours. We’re proud of this result (and are confident we can do it even faster), but each business is special, so there may be individual requirements for the launch, which we’ll inform you about separately if necessary.

How we check the merchant

In addition to analyzing the project, we’ll request from you the scans of the main legal documents. This is a standard procedure for checking the counterparty in accordance with the current legal requirements.

- For legal entities: an extract from the Unified State Register or a certificate, documents of the manager (passport + registration, tax number, minutes and order on the appointment of the manager), a certificate from the bank on opening an account of a legal entity, the company’s charter;

- For sole proprietors: an extract from the Unified State Register or a certificate of registration of a sole proprietor, documents (passport + registration and tax number), a certificate from the bank on opening a current account.

In addition to studying the technical readiness of the website of app to accept payments, we study your product and after OK from the legal department, we’re usually ready to offer the optimal setup of payment tools just for you.

Important: the rules and algorithm for connecting merchants from Ukraine and other countries will differ in accordance with the legal requirements of different states.

Step #3: Selecting the necessary tools

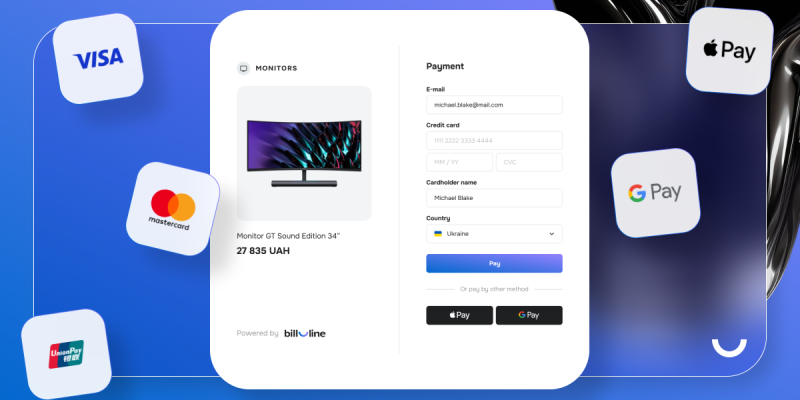

In most cases, partners with a website need Apple Pay and Google Pay online acquiring. Of course, the classic card data input remains, but it’s much easier to just press one button on your smartphone and confirm the purchase in mobile banking, isn’t it?

This is confirmed not only by statistics (more than 80% of partners note the fundamental nature of payments via Apple Pay and Google Pay mobile wallets), but also by conversion:

- The number of successful payments with card data input is on average around 90%;

- Conversion for payments using Google Pay and Apple Pay starts at 95%.

Integrating the bill_line payment solution into applications takes longer – but only if the product doesn’t yet have a developed userflow for payments. If it does, development time is minimized, as are the launch dates.

Each business is a unique story. Therefore, for each of you we offer your own setup of payment options. Some partners are good only with payments via Telegram Pay, while others need online acquiring with payment methods in half the world. Whatever the task, in the Swiss Army knife approach by bill_line will always find the right tool.

Step #4: Technical integration

This step will also receive an article later. So, after defining the necessary payment methods, you should integrate them. Our API is available at this link, and here your technical specialists can assess what work needs to be done. At each stage, you’ll have a full support from the bill_line tech team.

Step #5: Payment tests and launch

After completing the integration, each payment stage must be tested in different conditions. This is done by our support and Q&A departments. Security and quality are not an empty phrase for us, so the launch will take place only after we have worked out all the necessary scenarios and fixed possible errors.

Every day we work to make our services as convenient as possible and expand the pool of opportunities for our partners. We simplify bureaucratic and technical issues to get access to the system as quickly as possible.

Are you ready for partnership?

Then fill out the application form for connecting payments, and we’ll take care of the rest!